NFT Marketplace Development Renaissance: Why Marketplaces Matter in the Tokenization Age

It’s 7 a.m. in Seoul. A BTS fan scans a wrist‑band NFT to unlock a sound‑check stream while a Manhattan investor fractional‑buys a Milan apartment, all before the first cup of coffee.

NFTs have changed, the way we interact with them have changed, and the way they are distributed has also changed.

From JPEGs to Capital Markets: Where the Industry is Headed?

The times when NFTs were associated with images of apes and CryptoPunks are long gone. Now, use cases have matured, and the stakes have grown higher.

Sure, OpenSea is still alive, and people still buy unique digital art, but conventional businesses that have been waiting for more mature and feasible use cases are now entering the arena. They’re also removing the N and F from NFTs, reframing the technology as tokenization.

In the last few years, we’ve seen blockchain adoption across the board, from S&P 500 companies in a variety of industries such as Salesforce, Nike, BlackRock, and others.

One of the main reasons conversations have shifted from “NFT drops” to “tokenization strategies” is that the tech has finally caught up with enterprise expectations.

Scalability solutions, greener consensus models, and “blockchain‑as‑a‑service” stacks mean transactions that once took minutes (and a small fortune in gas) now settle in seconds and for pennies. Blockchain has become good enough for day‑to‑day, consumer‑grade workloads. On top, platforms like ours work hard to hide the plumbing altogether, so users swipe a card or sign in with email while smart contracts hum quietly in the background .

This availability is why we’re seeing Fortune-level brands pilot token-backed loyalty programs where points move fluidly between airline lounges, hotels, and retail partners, instead of a walled-garden environment where loyalty points go to die.

In gaming, publishers uncover new revenue by letting players trade in-game assets on open secondary markets, turning skins and weapons into portable digital goods instead of locked-in consumables.

The most explosive growth, though, sits in real-world-asset (RWA) tokenization. From fractional farmland and commercial real estate to royalty streams from a Rihanna hit, new opportunities emerge for retail investors (who now hold 51 % of the world’s wealth) to buy slivers of assets that were once invitation-only.

Capital markets are already eyeing this trend. BlackRock isn’t experimenting for the fun of it. The company is chasing the next trillion-dollar fund class.

It’s fair to say that the JPEG era grabbed headlines, but the current chapter will redefine business models. Let’s explore how NFT marketplaces fit into this chapter.

Why NFT Marketplaces Still Matter

Tokenization may have taken the place of digital art, but one part of the NFT stack remains unchanged: the marketplace. Here’s why:

Liquidity and Price Discovery

NFTs are scattered across multiple smart contracts and dozens of chains. Without a shared order book they’re functionally invisible.

For example, the new OpenSea OS2 rebuild solves this problem by integrating token swaps via liquidity aggregators. It pulls listings and token liquidity from multiple chains and DEX aggregators, letting users buy both NFTs and ERC-20 tokens across various chains in just a few clicks.

Marketplaces centralize NFTs, display real-time floor prices, and introduce additional features like analytics, making NFT management, trading, and exchanging far more user-friendly.

A UX Glue for a Growing Multichain Mess

As infra advancements make multichain more accessible, the puzzle becomes increasingly messy.

- Networks like Base explode in activity (>$15.5M fees in January 2025) as brands chase cheaper block-space.

- Polygon CDK, Arbitrum Orbit and zkSync Hyperchains have already given birth to dozens of single‑purpose L2/L3s (Immutable, Ronin, TON, etc.). They each mint their own NFTs and fragment liquidity. Marketplaces stitch them back together via shared order books, AggLayer routing, and on‑the‑fly asset wrapping.

Enterprise Compliance Guardrails

NFTs are now subject to a wave of fresh regulation worldwide. The EU’s Markets in Crypto-Assets (MiCA) framework forces European platforms to build tiered identity checks, real-time Travel Rule compliance, and on-chain royalty enforcement. Complementary AML laws and the EBA’s July 2024 Travel Rule guidelines extend the same standards to NFT marketplaces by 30 December 2024, making verified provenance non-negotiable.

Regulators outside Europe are moving just as fast. Hong Kong’s A-S-P-I-R-E roadmap now licenses tokenised-asset exchanges and spot ETFs, while the UK opened a Digital Securities Sandbox. Marketplaces therefore integrate sanctions screening, verifiable-credential log-ins, and automated royalty splits to stay inside the lines.

In this environment, NFT marketplaces step in as the on-ramps and off-ramps: they vet issuers, ensure compliant listings, match retail and institutional order flow, and route each trade through automated Travel Rule checks. By bundling KYC, price discovery, and secondary-market liquidity under one roof, marketplaces convert fragmented tokenized assets into plug-and-play products for wallets, custodians, and portfolio managers.

New Business Models are Born Inside Marketplaces

Marketplaces that survived the bear market have turned themselves into mini-ecosystems. Now, they have become a mix of DeFi, loyalty tech, and chain-hopping routers under one roof. Four shifts stand out:

Token + NFT rails are merging

OpenSea’s OS2 rebuild now lets you drop an ERC-20 and an NFT into the same checkout cart, pulling quotes from external DEX aggregators so price discovery happens in real time.

Marketplaces are becoming multichain trading terminals

Magic Eden’s recent purchase of Slingshot turns a once-Solana-only bazaar into a router for over eight million tokens across a dozen blockchains, without bridges or CEX detours, just search-and-swap. The lesson: liquidity follows convenience, not tribal loyalty.

Block-space futures open a brand-new derivatives lane.

On Coinbase’s Base roll-up, Alkimiya has launched a market where builders can hedge the cost of gas itself, going long or short on tomorrow’s block space just like airlines hedge jet fuel. For marketplaces that integrate these contracts, listing fees become an optional risk-management tool rather than a sunk cost.

Tech Shifts Builders Can’t Ignore

Ask any serious builder in 2025 what’s changed in the past two years, and you’ll get the same answer: everything beneath the surface.

It’s not just cheaper gas fees or new chains, though those matter too. What we’re seeing is foundational: blockchain tech is finally catching up to real-world expectations. Builders are moving beyond MVPs and hype cycles into robust, production-ready systems.

Let’s break down the most important shifts:

ERC‑6551 and Token-Bound Accounts

NFTs can now own assets, sign messages, and even trade, all autonomously.

With ERC‑6551 (Token-Bound Accounts), every NFT becomes a smart wallet. That means your character in a game can carry its own weapons, your event pass can hold your memories and perks, and your digital ID can interact directly with DeFi without jumping through wallet hoops.

For builders, this is a game-changer. It’s composability, on-chain reputation, and programmable value, all tied to a single, portable token.

Account Abstraction Goes Mainstream

Thanks to EIP-4337 and major support from Ethereum rollups, the wallet UX nightmare is finally being solved.

Users can now log in with email, recover accounts without seed phrases, and pay gas in stablecoins or avoid gas entirely. Platforms like Stackup and Alchemy’s AA SDK make account abstraction the default for any dApp aiming for scale.

For marketplaces and tokenized products, this reduces drop-off rates by orders of magnitude. It's no longer “connect your MetaMask or leave.” It's “sign up and go”.

Modular Rollups and Appchains

The Ethereum ecosystem is now bursting with app-specific L2s. Whether it’s zkSync’s Hyperchains, Arbitrum Orbit, or Polygon CDK chains, projects are building custom rollups that inherit security while customizing logic, fees, and governance.

Why does this matter?

Because the NFT infrastructure you spin up today might run its own chain tomorrow, with governance tailored to your DAO, block space reserved for your brand, and zero competition for bandwidth. Think Shopify, but for L2s.

That’s why we’re solving this problem at Kumo (powered by Vodworks). Our enterprise blockchain platform is chain agnostic: it lets clients launch custom NFT marketplaces on any leading blockchain and mint assets across networks, switching chains seamlessly in just a few clicks.

The Rise of Real-World Assets (RWAs)

NFTs are no longer digital toys, they are becoming legal wrappers for ownership.

In 2025, we’ve seen:

- Tokenized shares of Manhattan real estate

- Fractionalized music royalties

- Luxury watches with on-chain authenticity

What enables this is not just legal clarity. It is a marketplace layer that integrates KYC, allows restricted secondary trading, and ensures compliance through programmable contracts. In this space, marketplaces aren’t just where things get listed, they’re where regulatory controls get enforced.

Curious how real-world diamonds are leaping onto the blockchain? 🎧 Catch our newest podcast episode on RWA tokenization and get the full story.

Build vs Buy vs Partner: How NFT Marketplaces are Built Today

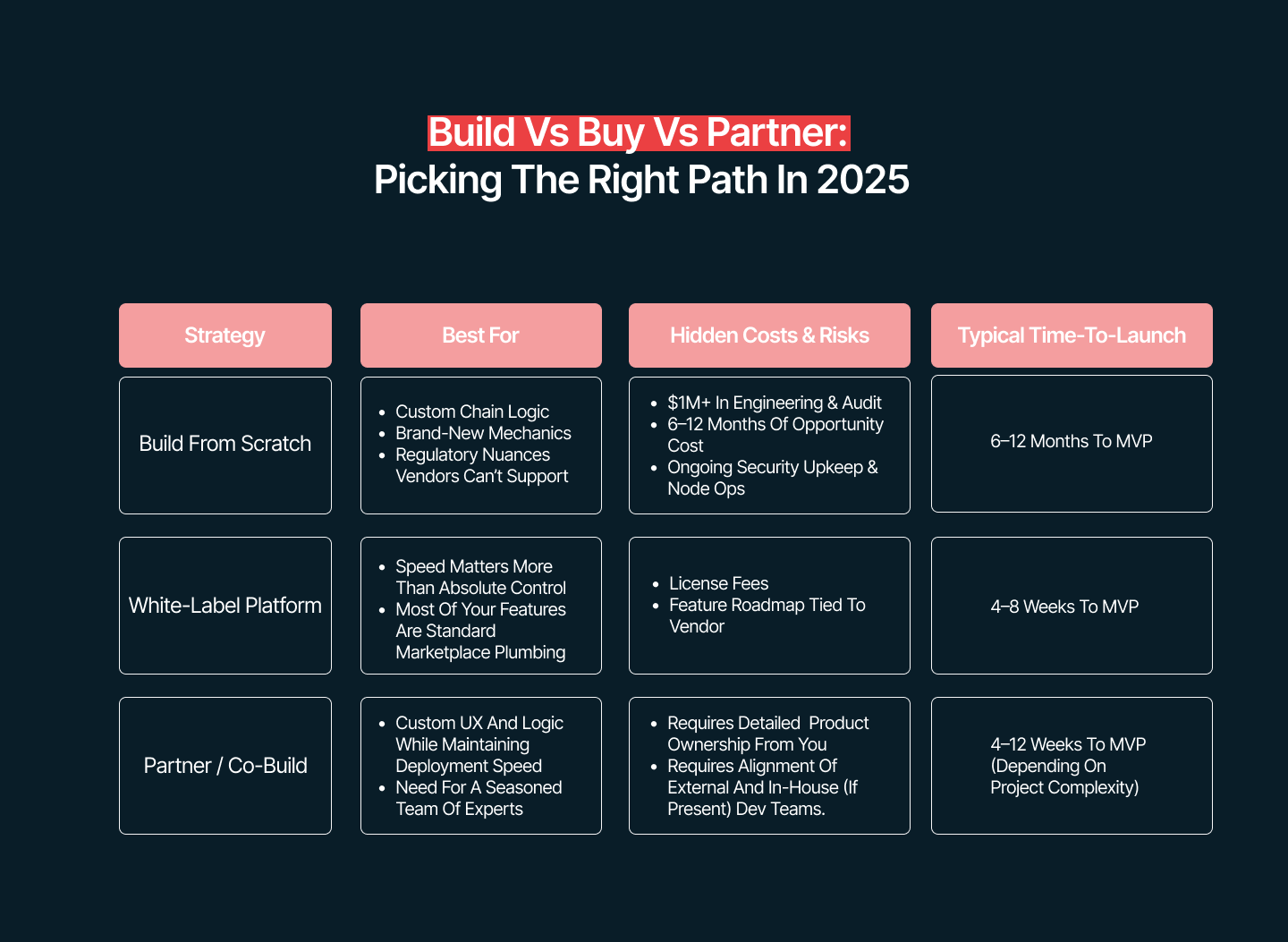

When the ROI math checks out and compliance teams green-light tokenization plans, teams face a tough crossroad: build a marketplace in-house, adopt an off-the-shelf white-label platform, or hire developers to bring decentralized vision to life.

Choosing the right approach still depends on these three classic, brutally practical variables:

- Speed to market. Token projects launch daily. Every week you’re not live is a week during which competitors capture liquidity and wallet share.

- Depth of differentiation. Are you really inventing new marketplace mechanics, or do you just need a trustworthy foundation?

- Total lifetime cost and risk. Do you have the time and resources to wrestle with security audits, node ops, compliance rewrites, and ever-changing regulatory landscape.

Plenty of teams still romanticize building from scratch for different reasons. Some think this approach gives them more control, and others think that white-label platforms aren’t flexible enough for the features they have planned.

In 2025, in-house NFT marketplace projects can easily reach 7 figures just to build an MVP, that’s before audits and ongoing infra bills.

Today’s white-label marketplace platforms can cut development timelines to a few weekly sprints and halve production costs. But whether a white-label solution is a good fit depends heavily on the specifics of your project. You have to surrender some control over the roadmap in favor of speed to market.

Then, there’s the partnership model. It uses the white-label platform as a foundation, co-building custom features on top with a vendor. It sits between the extremes in cost, speed, and flexibility. This model often becomes the best option when teams hit a wall trying to scale solo.

Let’s take a closer look at the aspects of each model below.

Things to keep in mind:

Things to keep in mind:

- In-house builds are getting more expensive. Every new bridge, rollup, ERC standard, and regulatory mandate adds code to maintain and audits to pay for. Build complexity is constantly growing, which increases long-term spend.

- White-label stacks like Kumo compress launch cycles to a few weekly sprints because wallet abstraction, multichain routing, and marketplace admin features come pre-wired.

- Projects that start fully white-label often pivot to a hybrid model (base platform + custom add-ons) once they hit compliance hurdles or secondary market liquidity gaps.

Future-Proof Checklist for NFT Marketplace Development

Blockchain standards change with the speed of light. What looks state-of-the-art today can feel like legacy in several months. Think of the list below as “anti-technical-debt insurance” for marketplaces.

1. Account Abstraction (ERC-4337)

Smart-account wallets let users sign in with email or biometrics, recover keys socially, and pay fees in any token. Implementation is a matter of wiring an AA SDK (Stackup, Alchemy, Biconomy) into your auth flow. The sooner it’s done, the lower the churn you’ll see at checkout.

2. Token-Bound Accounts (ERC-6551)

Give every NFT its own programmable wallet. ERC-6551 allows every NFT to have its own accounts that can store additional assets. This means a gaming character can now lug around its own inventory, a tokenized pass can auto-claim perks, a supply-chain asset can hold audit certificates. Here’s a graph showing the flow between user, NFTs, and programmable wallets:

Supporting ERC-6551 is mostly about two things: minting through the registry contract and exposing “assets owned by this token” in your UI.

Supporting ERC-6551 is mostly about two things: minting through the registry contract and exposing “assets owned by this token” in your UI.

3. Multichain Liquidity Routing

Expecting people to move their assets from one chain to another on their own is unrealistic. Your backend needs shared order books, asset wrapping, and one-click checkout across rollups (Base, Polygon zkEVM, Arbitrum, etc.). Aim for “list once, sell anywhere,” and you’ll never lose volume to chain tribalism.

4. Modular-Rollup Optionality

Today you’re on a shared L2. Tomorrow you may want your own app-chain for latency, governance, or brand reasons. Choose infrastructure that can redeploy on Polygon CDK, Arbitrum Orbit, or zkSync Hyperchains with minimal code changes.

Bake these four items into your first release, and you won’t be ripping out core code every time the ecosystem changes. Instead, upgrades will feel like toggling features.

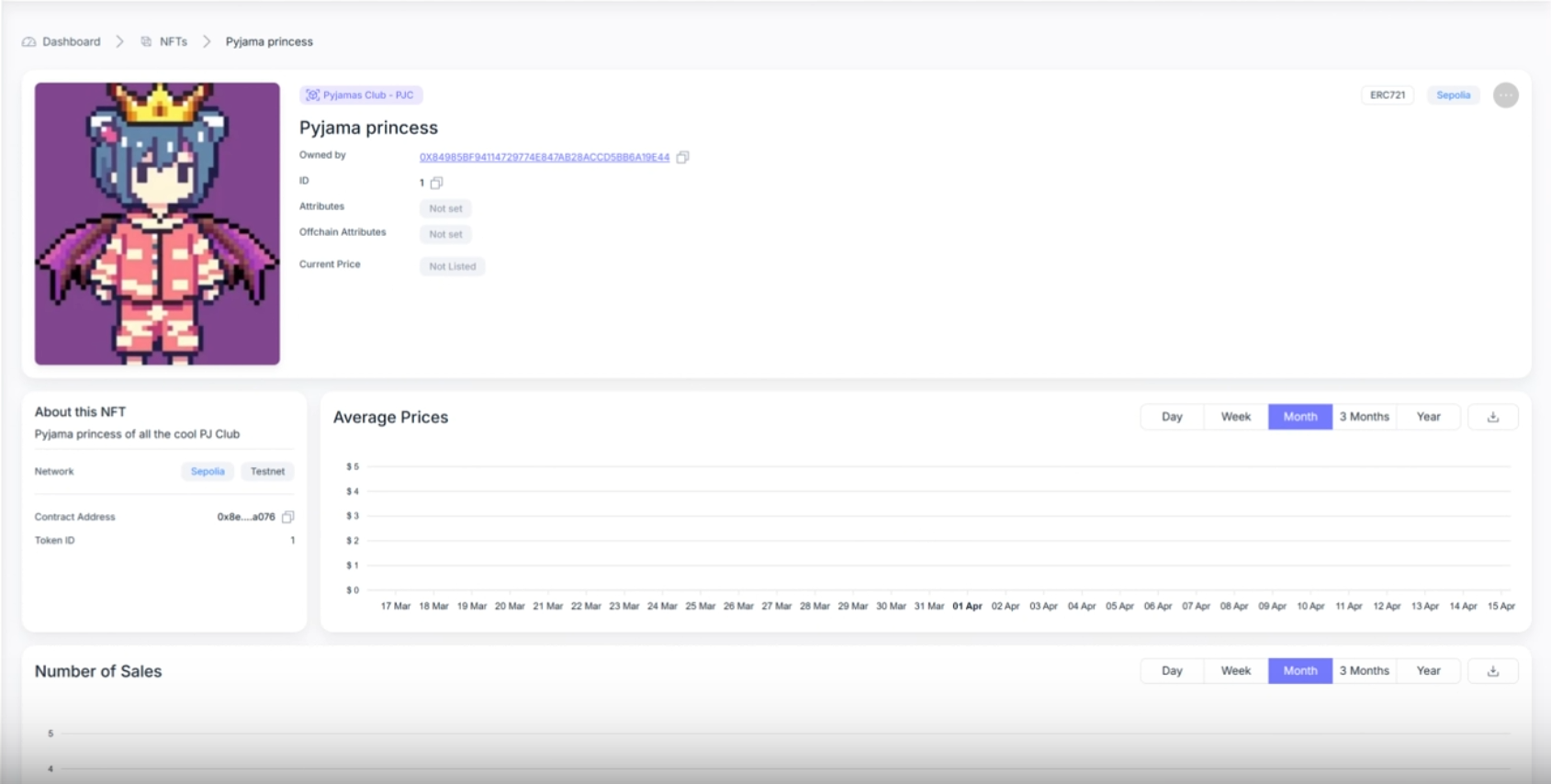

Kumo: Out-of-the-Box Infrastructure & Management Solution for NFT Marketplaces

Most brands don’t have a full-stack Web3 development team, months to prototype, and budgets for endless audits and feature rewrites. That’s why we turned years of experience in custom marketplace builds into Kumo, an enterprise blockchain platform that covers every layer of NFT marketplace engineering, streamlines minting, abstracts multichain routing, and lets you launch a fully branded, compliance-ready marketplace in weeks instead of quarters.

What’s inside Kumo:

Two control panels for scale and governance

The Superadmin panel oversees multiple marketplaces; Admin runs a single brand. Both panels come with 2-FA login, fee dashboards, and real-time metrics, so ops teams control blockchains, tokens, collections and users without touching code.

One-click multichain support

One-click multichain support

Switch across blockchain straight from the UI. Each chain brings its own community, gas profile and speed. Kumo lets you capture them all without redeploying contracts.

Asset studio, drops & lazy-minting

Asset studio, drops & lazy-minting

Create collections, mint NFTs, or schedule time-boxed drops (ERC-721 Drop) in minutes. Items appear live on your storefront the moment the transaction confirms.

Seamless monetisation

Seamless monetisation

Set marketplace fees, automate royalties, or launch promos directly from the dashboard; changes propagate instantly to every listing.

Instant migration via contract address

Paste an existing collection’s contract, hit Add, and it’s live. Ideal for brands migrating from OpenSea or other NFT marketplaces.

Powered by Vodworks, Kumo isn’t just software, it’s a direct hotline to our team of blockchain experts. Need custom tokenomics, a tailored UX, or any other add-ons? Our team plugs in as your on-demand R&D squad, bringing your vision into life.

Ready to skip the seven-figure learning curve? Let’s discuss your use case.

Talent Shortage Holding You Back? Scale Fast With Us

Frequently Asked Questions

In what industries can Web3 technology be implemented?

Web3 technology finds applications across various industries. In Retail marketing Web3 can help create engaging experiences with interactive gamification and collaborative loyalty. Within improving online streaming security Web3 technologies help safeguard content with digital subscription rights, control access, and provide global reach. Web3 Gaming is another direction of using this technology to reshape in-game interactions, monetize with tradable assets, and foster active participation in the gaming community. These are just some examples of where web3 technology makes sense however there will of course be use cases where it doesn’t. Contact us to learn more.

How do you handle different time zones?

With a team of 150+ expert developers situated across 5 Global Development Centers and 10+ countries, we seamlessly navigate diverse timezones. This gives us the flexibility to support clients efficiently, aligning with their unique schedules and preferred work styles. No matter the timezone, we ensure that our services meet the specific needs and expectations of the project, fostering a collaborative and responsive partnership.

What levels of support do you offer?

We provide comprehensive technical assistance for applications, providing Level 2 and Level 3 support. Within our services, we continuously oversee your applications 24/7, establishing alerts and triggers at vulnerable points to promptly resolve emerging issues. Our team of experts assumes responsibility for alarm management, overseas fundamental technical tasks such as server management, and takes an active role in application development to address security fixes within specified SLAs to ensure support for your operations. In addition, we provide flexible warranty periods on the completion of your project, ensuring ongoing support and satisfaction with our delivered solutions.

Who owns the IP of my application code/will I own the source code?

As our client, you retain full ownership of the source code, ensuring that you have the autonomy and control over your intellectual property throughout and beyond the development process.

How do you manage and accommodate change requests in software development?

We seamlessly handle and accommodate change requests in our software development process through our adoption of the Agile methodology. We use flexible approaches that best align with each unique project and the client's working style. With a commitment to adaptability, our dedicated team is structured to be highly flexible, ensuring that change requests are efficiently managed, integrated, and implemented without compromising the quality of deliverables.

What is the estimated timeline for creating a Minimum Viable Product (MVP)?

The timeline for creating a Minimum Viable Product (MVP) can vary significantly depending on the complexity of the product and the specific requirements of the project. In total, the timeline for creating an MVP can range from around 3 to 9 months, including such stages as Planning, Market Research, Design, Development, Testing, Feedback and Launch.

Do you provide Proof of Concepts (PoCs) during software development?

Yes, we offer Proof of Concepts (PoCs) as part of our software development services. With a proven track record of assisting over 70 companies, our team has successfully built PoCs that have secured initial funding of $10Mn+. Our team helps business owners and units validate their idea, rapidly building a solution you can show in hand. From visual to functional prototypes, we help explore new opportunities with confidence.

Are we able to vet the developers before we take them on-board?

When augmenting your team with our developers, you have the ability to meticulously vet candidates before onboarding. \n\n We ask clients to provide us with a required developer’s profile with needed skills and tech knowledge to guarantee our staff possess the expertise needed to contribute effectively to your software development projects. You have the flexibility to conduct interviews, and assess both developers’ soft skills and hard skills, ensuring a seamless alignment with your project requirements.

Is on-demand developer availability among your offerings in software development?

We provide you with on-demand engineers whether you need additional resources for ongoing projects or specific expertise, without the overhead or complication of traditional hiring processes within our staff augmentation service.

Do you collaborate with startups for software development projects?

Yes, our expert team collaborates closely with startups, helping them navigate the technical landscape, build scalable and market-ready software, and bring their vision to life.

Our startup software development services & solutions:

- MVP & Rapid POC's

- Investment & Incubation

- Mobile & Web App Development

- Team Augmentation

- Project Rescue

Subscribe to our blog

Related Posts

Get in Touch with us

Thank You!

Thank you for contacting us, we will get back to you as soon as possible.

Our Next Steps

- Our team reaches out to you within one business day

- We begin with an initial conversation to understand your needs

- Our analysts and developers evaluate the scope and propose a path forward

- We initiate the project, working towards successful software delivery